Pensions

So, that sexy topic of pensions. We appreciate how easy it is to put this off. Short-term gain over long-term pain and all that.

But when you really break it down, expert pensions advice and insights can make all the difference further down the line.

What are pensions?

First of all, here’s a quick refresher of what “money purchase” pensions actually are.

A money-purchase “pension” is fundamentally just a big pot of money.

The size of the pot when you retire will depend on how much you have paid into it, the number of years for which you have contributed, and the extent of any investment-related growth.

One day, when you retire, you will start drawing an income from this pot of money. The larger the pot, the higher the income might be.

When you die, whatever is left in that pot of money can be left to whoever you want. Your spouse, your kids, the man who walks the dog over the road, anyone.

Young professionals and young families

It’s undeniable that contributing properly to your pension from the very start of your career – or even a few years in – can make a massive difference. If you start paying into a pension aged 35 rather than 25, and get the same average investment growth, then you will have to contribute twice the amount of money each and every year to accumulate an identical pension pot by the time you retire. Twice! That’s just a mathematical fact.

That aside, we can help you estimate a sensible post-retirement income based on your current – and projected future - pension contributions. We can then build a financial model to demonstrate the extent to which minor adjustments today might result in exponentially greater returns by the time you retire.

If you tell us that you need a specific amount per month when you retire, then we’ll help you work out what that translates to in terms of current contributions. If you can’t currently afford those contributions, then we’ll happily assess your fixed and variable costs. We’ll really lay bare your expenditure and provide practical, tailored solutions to help you reach that number. Rest assured, our approach is far more about behavioural coaching and efficiency solutions than us trying to restrict your lifestyle.

Entrepreneurs and business owners

If you’re an entrepreneur or business owner and you’re not yet familiar with the acronyms SSAS or SIPP, then if there’s any part of this website that you should be reading, it’s this. Trust us…

As we all know, the traditional route for commercial funding typically involves borrowing money in return for granting security over our personal assets (often our homes) and repaying the loan - plus interest - over time. However, over the previous decade it has become increasingly difficult to borrow, with lenders requiring an ever-increasing array of security to protect their positions. This is where SSAS arrangements come into their own.

SSAS

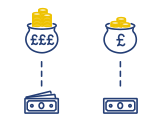

SSAS stands for “small self-administered scheme”, a pension scheme which can provide a highly-beneficial alternative mechanism for entrepreneurs and business owners looking to fund their commercial activities. A SSAS can be set up and independently managed by any company, meaning those that control the company, control the pension scheme (although a SSAS is limited to 11 member trustees).

The company’s owners can therefore determine how to invest the funds held in the SSAS pension pot, for example by investing in a portfolio that aligns with each owner’s risk appetite, in commercial property, or in the company itself. The company can also borrow directly from the scheme, and a SSAS doesn’t require the member trustees to call upon a personal guarantee or a personal asset such as your home as security. What’s more, any interest payments on SSAS loans will go right back into the pension pot. Win/win right?

However, only limited companies can adopt a SSAS. So what about individuals, partnerships, LLPs and sole traders? Let us introduce you to our other friend, SIPP…

A loan from a SSAS to your company will require a first charge on a suitable asset as security.

This asset may be repossessed if you do not keep up repayments on a SSAS loan secured on it.

With Small Self-Administered Schemes, as with all investments, you’re your capital is at risk.

The value of what you put in may go up as well as down.

Whilst Small Self-Administered Schemes are not regulated products, advice on the underlying investments is regulated.

SIPP

SIPP stands for “self-invested personal pension”, a pension scheme which can provide another flexible alternative for entrepreneurs and business owners, including those who don’t operate through limited companies. Like a SSAS, a SIPP can enable a business owner to invest their pension funds in commercial property or a portfolio that aligns with their risk appetite. However, unlike with a SSAS, businesses cannot borrow from SIPPs and SIPPs are limited to only one member.

How can we help?

So how can we help? Well, we can set up these schemes, carry out any necessary due diligence, then transfer your existing pension pots into the consolidated SSAS or SIPP bank account. We can then help you to manage and administer the scheme on an ongoing basis.

Experienced professionals and business leaders

If you’ve worked for multiple companies throughout your career, you’ll likely have funds sitting in a multitude of pension pots. You may not even know where these “pots” are located. We can start by consolidating these and helping you to understand the wealth you’ve accumulated and what this means in terms of future retirement income.

If you tell us that you need a specific amount per month when you retire, then we’ll help you work out what that translates to in terms of current contributions. Actionable advice that you can use to adapt your approach if necessary. And if you’re one of the lucky ones who thinks early retirement might be on the cards, then this type of analysis can really bring that dream into fruition.

People approaching or commencing retirement

Once you are gearing up to retire (or perhaps semi-retire), you will face the intimidating prospect of retreating from a long-standing and reliable source of income, instead relying on a regular income from your pension pot. On the face of, the extent of this income will depend entirely on the size of that pot. However, in reality, it’s a little more complicated than that, as most modern pensions offer more flexibility than ever before. They also interact with your other assets in increasingly complicated ways. Throw in the tax many tax considerations, simultaneous state pension benefits and the lifestyle adjustments that come with age, and it can all become a bit of a minefield.